Diminishing balance formula

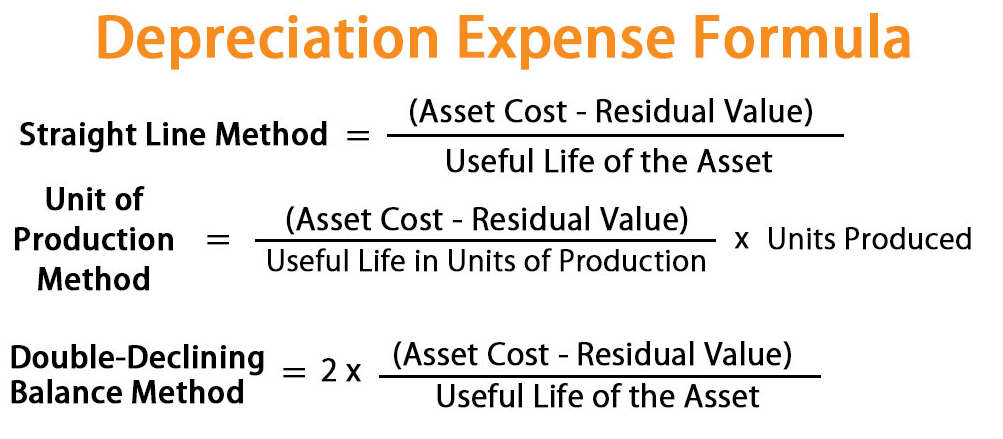

The diminishing balance method is a. Depreciation amount opening balance depreciation rate.

Declining Balance Depreciation Double Entry Bookkeeping

Depreciation amount 1750000 12 210000.

. 2003 machinery was purchased for Rs 80000. Declining Balance Method. 2000 - 500 x 30 percent 450.

A declining balance method is a common depreciation-calculation system that involves applying the depreciation rate against the non-depreciated. Depreciation amount book value rate of depreciation100. 2004 additions were made to the machinery of Rs 40000.

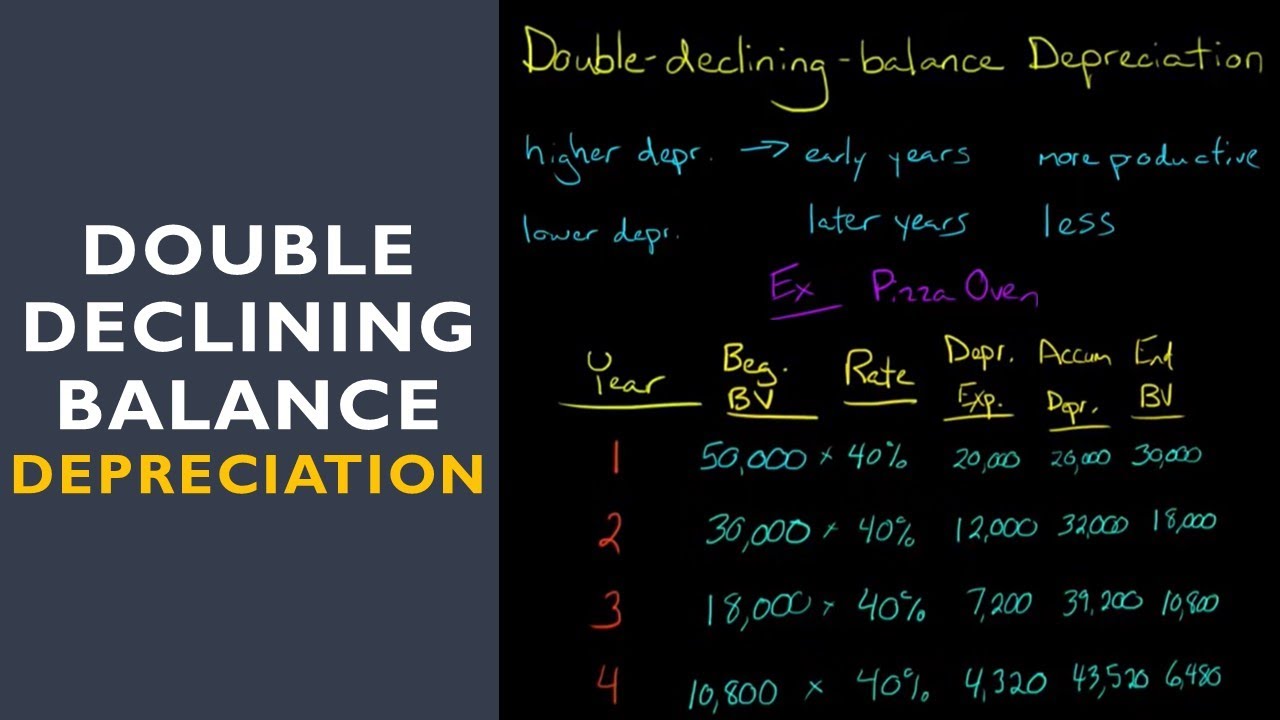

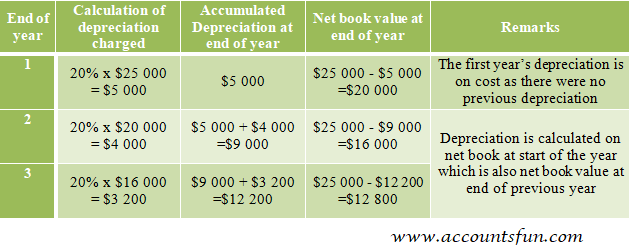

Recognised by income tax. The diminishing balance method is a method of calculating the depreciation expense of an asset for each accounting period. The double declining balance depreciation method is one of two common methods a business uses to account for the.

Diminishing Balance Depreciation is the method of depreciating a fixed percentage on the book value of the asset each accounting year until it reaches the scrap value. Depreciation by Diminishing Balance Method On 1st Jan. Year 2 2000 400 1600 x.

In this lesson we explain what the straight line and diminishing balance depreciation methods are show the formula for calculating the depreciation methods. When using the diminishing value method you would. Double Declining Balance Depreciation Method.

1235 - 500 x 30 percent 220. 1550 - 500 x 30 percent 315. As it uses the reducing.

Some of the merits of diminishing balance method are as follows. What is diminishing reducing balance method. The company wants to depreciate the machine using the diminishing balance depreciation method with a.

Thus the value of the equipment is diminished by Rs 10000 and becomes Rs 90000. For example the diminishing value depreciation rate for an asset expected to last four years is 375. For the second year the depreciation charge will be made on the diminished value ie.

The diminishing balance method of depreciation or as it is also known the reducing balance method calculates depreciation as a percentage of the diminishing value of. Diminishing Balance Method Example. Closing balance opening balance depreciation amount.

Double Declining Balance Depreciation Method Youtube

Double Declining Balance Method Of Depreciation Accounting Corner

Double Declining Balance Method Of Depreciation Accounting Corner

Double Declining Balance Method Of Depreciation Accounting Corner

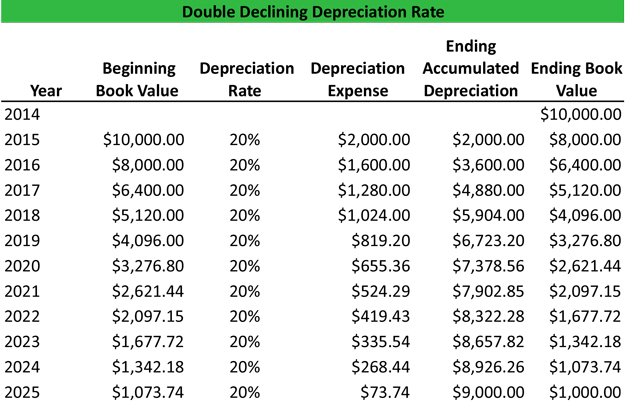

Double Declining Balance Depreciation Calculator

Diminishing Balance Depreciation Method Explanation Formula And Example Wikiaccounting

Declining Balance Method Of Depreciation Formula Depreciation Guru

What Is The Double Declining Balance Method Definition Meaning Example

What Is Double Declining Balance Method Of Depreciation Pmp Exam Accelerated Depreciation Youtube

Depreciation Formula Examples With Excel Template

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense

What Is The Double Declining Balance Ddb Method Of Depreciation

Double Declining Balance Depreciation Daily Business

Reducing Balance Depreciation Calculation Double Entry Bookkeeping

Straight Line Method Vs Diminishing Balance Method Depreciation Calculation Examples Youtube